Sneha Abraham remembers her 2016 trip to Barcelona like it was yesterday. She and husband Ronnie, who ran a successful tennis centre in Bengaluru, visited Barcelona Total Tennis (BTT) to invite Francis Roig to India for an exchange programme. Roig, one of the founder-directors of BTT, is the long-time technical coach of tennis legend Rafael Nadal. Like most tennis academies in Spain, BTT was also home to a padel club.

“The ratio of padel courts to tennis courts was five to one. The tennis courts were empty, while the 8-10 padel courts at the facility were full. The cafés there were teeming with people awaiting their turn. It was something out of a movie,” Abraham recalls in a conversation with The Playbook. That, she says, was her driving force behind bringing padel to India. “It felt like a healthier alternative to socialising. The spirit of padel — its inclusiveness, classiness, and ease of picking up, were major factors to bring it to India, and particularly Bengaluru, where I felt it would stick.”

Padel is a racket sport that’s a mix of squash and tennis. It was founded by chance in 1969 in Acapulco, Mexico, where founder Enrique Corcuera — who also played the sport of Basque pelota — set up an indoor space measuring 20x10 metres. Padel is typically played in an indoor doubles court, with an underarm serve and the tennis scoring system (except for the golden point).

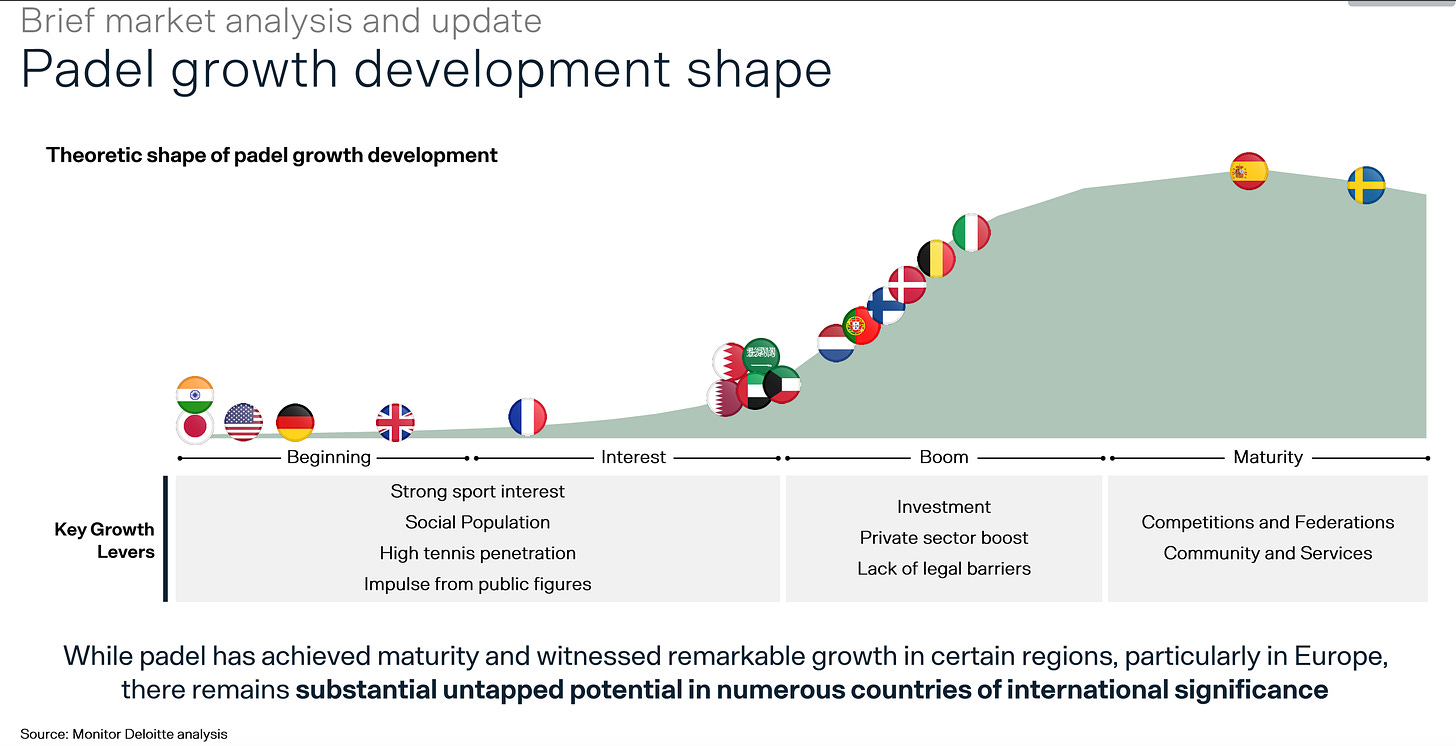

It is today the world’s fastest-growing sport, with over 30 million amateur players across 100+ countries. Forty per cent of these players are women, according to a recent report released by the Federación Internacional de Pádel (FIP), the sport’s Switzerland-headquartered governing body. Globally, 71 countries have national federations officially affiliated with the FIP. The business of padel is booming too, with billion-dollar opportunities across infrastructure (courts and clubs), equipment (rackets), and distribution (media rights).

Having worked in multinational companies in areas such as governance, process management, and operations, and with Abraham's sports business experience, administration was a calling. And also why, after her return from Barcelona, she would write to the FIP for the next steps to build and promote the sport in India. “We reached out to them, and they saw our passion and advised us to take the Indian market by forming a federation,” she adds. Thus the Indian Padel Federation or the IPF, which Abraham currently heads, was formed in 2017, with the country’s first padel court in Bengaluru’s posh Sadashivanagar locality.

Today, padel has attracted over a million players who have tried the sport (at least once) in India, with over 2,000-3,000 regular players (those who play between 1 and 3 times a week), chiefly in Mumbai and Bengaluru. A significant majority of this has come in the last 15-18 months when access to padel courts has expanded — from 10 between 2017 and 2022 to 80-100 in 2024 — and increasing awareness has kicked in. “At the moment, padel is a recreational sport. People who have tried other racket sports are not the only potential players. More than 50% of the people who play padel have never played a sport in their life,” IPF general secretary Ronnie Sehgal tells The Playbook.

Last year, a report by European racket sports booking app Playtomic and Deloitte estimated that the global padel club market would be worth about €4 billion ($4.3 billion) by 2026, up from €1.177 billion or $1.92 billion at the start of 2023.

“The boom started early, and it is here to stay,” says Victor Ruiz, COO of Miami-based Reserve Padel, an influential members-only padel club in the United States. The company, Ruiz says in a conversation with The Playbook, deployed over 50 courts last year, and aims to double that number this year. Members of the Reserve Padel club include former English football legend David Beckham, tennis legend Andre Agassi and basketball star Dwayne Wade.

Padelnomics

Unlike its oft-quoted rival pickleball, padel is an expensive sport, heavy on infrastructure. There’s glass, there’s metal, and then there’s turf, and all of the highest quality, which would require at least Rs 25 lakh of investment per court. That’s roughly 10 times the cost of a pickleball court. In India, the challenge of finding the right real estate for the right price in urban centres is especially pronounced. Pair that with the sport’s growth model globally, i.e. the traditional padel club model such as Ruiz’s, where revenue opportunities spring up beyond just the utilisation of infrastructure or equipment.

“The only option,” says Ronak Daftary of Mumbai-based PadelPark, “is to rent land in places like Bengaluru and build from the ground up.” Daftary was involved in the astroturf business for the last decade. Given his access to already existing infrastructure and a network to boost, padel was an obvious choice. Today, PadelPark sells close to 10-15 courts every month, with customers ranging from private villas in nearby Alibaug to country clubs in Mumbai.

In 2024 so far, PadelPark has sold roughly 25 padel courts, each costing between Rs 20 and 25 lakh. It is also setting up nine courts of its own, which it will monetise via a utilisation and academy model by bringing in globally renowned coaches such as Spaniard Victor Perez.

“We have people booking in for the entire year,” Daftary tells The Playbook. The courts are priced at an hourly rate of Rs 2,000. With over 5600-6000 unique players in Mumbai and roughly 20% of those active, Daftary reckons that it is not impossible to “recover the money in 18-24 months.”

It is this model and its billion-dollar potential that attracted Irishman Alan Healy to India in 2022. Healy was an investor at Singapore-based Arisaig Partners, a public markets-focused fund. Padel was a sport he fell in love with, having witnessed its wild popularity in Spain around 2015-16. And when he moved back home to Ireland during Covid, stringent restrictions meant that local tennis courts converted themselves into padel clubs.

“I had these clubs on my doorstep,” he tells The Playbook from Barcelona, where Healy, like Daftary, was part of a 7-8 member delegation attending the inaugural World Padel Summit, an industry event. Healy’s involvement with padel increased: he invested early in British tennis star Andy Murray’s startup, Game4Padel.

Healy would go on to start Padel India, an “end-to-end” startup that aims to become the go-to destination for padel in India. He likens an hour of padel to “buying a beer during a night out” or “a cup of coffee”, and just as addictive. “We’re building the coffee of sport,” he says. “That number of coffee drinkers in India is approximately 60 million currently. We can easily manage 20% of that, or roughly 15 million players in the next 10-12 years.”

While that sounds ambitious, a significant part of Padel India’s plan involves developing its dedicated padel clubs. To this effect, it is already building a seven-court facility in Bengaluru’s Koramangala, and another six-court project in the city. In Hyderabad, the startup has partnered with Indian badminton legend, and IPF advisor Pullela Gopichand to build a four-court setup. It is also building other two-court facilities in Mumbai and Delhi.

Padel India will monetise via multiple avenues including a pro shop (for equipment), coaching, merchandise, pay and play, and ancillary revenues such as food and beverages and events. All of these, Healy believes, could propel what could be a $25 billion market by 2038 or 2040.

“The economics comes down to two things: utilisation of the court and price per hour. If we can bring the price per hour down to Rs 400 an hour so that an IT professional earning Rs 1 lakh a month can play it, that would be great,” says Shyam Mehta, a private equity investor at Craegis PE and a padel enthusiast. “This is a highly profitable investment globally, with the return on capital employed close anywhere between 30 and 35%. That is a better return than other businesses, let alone sport.”

But before that, there’s work to be done. Lots of it.

Groundwork

The key to the successful growth of any sport in India is official recognition; in this case, the Sports Ministry and the Sports Authority of India (SAI). That gives access to government subsidies while minimising real estate hassles. To be recognised as a federation, a sport has to be played and administered in at least 2/3rds of the country’s states. The federation has applied for recognition, and given the surge in interest in the sport, it should be completed “by the end of this year or latest sometime early next year.”

While that is one piece of the growth jigsaw, access to inexpensive equipment is integral to growing the sport. Today, an amateur padel racket costs Rs 2,999 on Decathlon, while more expensive models by brands such as Babolat or Head can go as high as Rs 30,000. For now, all stakeholders are engaging with these brands to crack ideal equipment prices for the Indian market, with the eventual goal of manufacturing in India itself.

“The question is: once they’re done, how far are they willing to go with their research, testing, and quality for rackets?” says IPF’s Sehgal. Decathlon, for one, has been following the padel boom trajectory, particularly in the last one or two years. In March, it installed its first padel court in Bengaluru. “Decathlon’s involvement is important. Investors keen to do something in padel should see that as a writing on the wall,” he adds.

Equally important is a strong coaching programme at the grassroots level. Currently, the number of courts and training facilities are a hindrance to coaching. But that could change once dedicated facilities, either in educational institutions, come up, or investors, buoyed by the sport’s potential, set up private academies. At a federation level, this is emerging as a top priority.

“The difference in India is to run a strong children’s programme. When it comes to kids, we need to find a way to subsidise it [the sport], so that the opportunity is not lost for excellence,” Sehgal says.

And finally, it needs a Dubai moment. Padel in India has benefitted from the boom in the United Arab Emirates (UAE). The UAE is considered one of the sport’s hotspots in Asia, and with an active diaspora player base, India is feeling the ripple effect. The country has 950 padel courts, most built during and after Covid. The Emirates’ crown prince Sheikh Hamdan bin Rashid Al Maktoum is an active padel player, which helps the sport’s cause. A similar push is what Healy’s startup Padel India is likely to bank on, with a big name being unveiled soon.

“The typical customer acquisition model for padel has been to rope in a celebrity and grow the sport. In the UK, that happened with Andy Murray and cricketer Jos Butter. In Spain, it is Rafael Nadal. In Switzerland, it's Roger Federer, and of course Lionel Messi in Argentina. That model has worked globally, and we believe it will hold good for India,” Healy says. Several current and former Indian cricketers such as Sachin Tendulkar, Mahendra Singh Dhoni, Sanju Samson, and Shubhman Gill have played the sport. Actors Hrithik Roshan, Shanaya Kapoor, and Rhea Chakraborty have also tried padel.

Eight years after her Barcelona adventure, Abraham is quietly confident that the sport finally has the wings to fly. She recounts an episode from 2019 in Tokyo when several tennis players from Bengaluru were honoured to represent the country in the Asian Padel Cup.

“It is a source of immense joy and pride for parents to say that their children represent the country, and I am glad padel made it possible” she says, before adding:

“What I’ve come to realise is that padel is not a hobby, it is an emotion.”

⚡️Quick Singles

🔵⚽️🆕: Argentine football manager Mauricio Pochettino left Chelsea “by mutual consent” less than a year after he took up the job. Chelsea finished sixth in the Premier League under Pochettino and are currently scouting his replacements, including Ipswich Town manager Kieran McKenna, Brentford boss Thomas Frank and Leicester City manager Enzo Maresca.

🏏💰🆕: The Board of Control for Cricket in India roped in Wonder Cement as an official umpire sponsor for the ongoing edition of the Indian Premier League. The deal, The Economic Times, reported, is worth Rs 250 crore and has come into effect since the playoffs. Wonder Cement will replace Paytm to join the BCCI as the sixth central sponsor, with its contract running until 2028.

⏱⏭️❎: A snap general election in the United Kingdom will delay the appointment of the independent football regulator “until at least next year”, per The Athletic. The English Football League, a proponent of the legislation, was hoping for its passage since it would have pushed the Premier League to distribute more finances to the lower leagues. The Labour Party, considered favourites to win the election, could reintroduce the bill once it comes to power.

🏎️🇹🇭🌏: Formula One could be looking to add another race to its Asian calendar, according to a Motorsport.com report. Thailand, the report added, has emerged as a contender for a future race, while South Korea’s Incheon could come back to the calendar starting in 2026 or 2027. Last month, Thai prime minister Srettha Thavisin met F1 CEO Stefano Domenicali.

💰🇮🇹🆕: Italian club Inter Milan found new owners in American investment fund Oaktree Capital Management after the club’s Chinese holding company Suning failed to meet a debt repayment deadline. Oaktree had previously granted a loan to Suning in 2021, guaranteed by their stake in the club. With the deadline passing on Tuesday, Oaktree took charge. Inter won their 20th Serie A title last month after defeating city rivals AC Milan.

📖 Weekend Reading

The Soccer Team That Forgot How To Lose [The Wall Street Journal]

What’s happening to cricket in Jamaica [ESPNCricinfo]

Turkish football’s season from hell points to deeper societal malaise [The Financial Times]

That’s all for this week. If you enjoyed reading The Playbook, please share it with your friends, family, and colleagues. Please also subscribe to it (for free) if you haven’t already.

You can reach out to me at venkat@thecore.in with any feedback (good, bad, or ugly), tips, and ideas. I take my mailbag seriously, and would love to hear from you! You can also connect with me on X (@venkatananth) and LinkedIn. Thanks for reading, and see you again next Friday!